AstraZeneca-Corporate Strategy Assessment

Author: Jamie Walker

At: July 21, 2023

Introduction:

This report aims to critically evaluate the corporate strategy of AstraZeneca (a well-renowned British-Swedish-based multinational pharmaceutical company). The report is based on three sections; firstly, a comprehensive analysis of the external factors is provided to assess the macro-environmental impacts through the PESTLE framework, and Porter Five Forces analysis for the industry competitiveness. Secondly, the micro environmental factors are critically evaluated through the VRIO and Resource Based View (RBV) framework. Lastly, an evaluation of the viability of an acquisition is presented based on SAFe Framework.

AstraZeneca’s background:

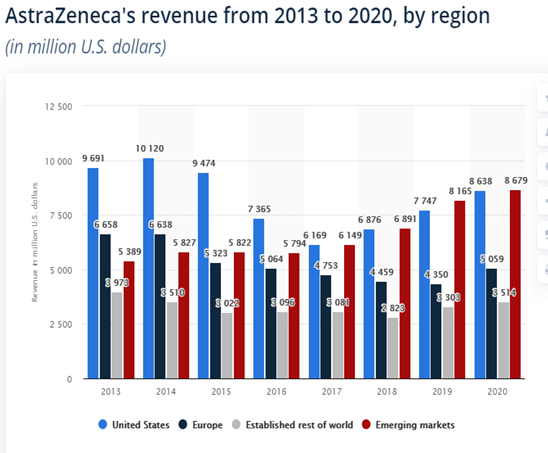

AstraZeneca is a multinational pharmaceutical and biotechnology company with the headquarter in Cambridge, England. With an extensive network in multiple countries, the AstraZeneca has over 76,100 employees worldwide (An, 2021). The portfolio products of AstraZeneca include the prevention of major diseases, including respiratory, cardiovascular, oncology, infection, inflammation, gastrointestinal and neuroscience. The revenue of AstraZeneca is reported to have a gigantic rise of 10% in the year 2020, with record revenue of over USD 25.8 billion for the year 2020 (Statista, 2021). Despite the pandemic, the sales of AstraZeneca increased enormously and is expecting revenue growth in 2021 of a “low teens percentage”. The sales by region shows that AstraZeneca has generated a remarkable market in the emerging and developing economies which accounts for the highest share in the revenue in 2020. The business

External Analysis (Macro-Environmental Factors):

As the headquarter of AstraZeneca is based in the UK; hence the PESTLE analysis for UK based market is given for the regulating business market and factors impacting business ventures in the UK and other markets of the pharmaceutical industry.

PESTLE Analysis:

The PESTLE (Political, Economic, Social, Technological, Legal and Environmental) analysis of the AstraZeneca is given as;

Political:

Among the healthcare authorities across the globe, the ever-increasing competition has led to the enormous pressure of political intervention. The obtrusion of the different government and political authorities in the pharmaceutical industry is based on working for the certifications, safety standards and drug-related laws.

- The different economies across the world have imposed strict regulations and policies for the supply and usage of pharmaceutical drugs, which is hindering the global pharmaceutical industry very badly.

- Similarly, the influence of the UK and US governments on the prices of the products in this industry is adversely impacting the growth of the industry, and companies are facing enormous challenges financially (Mulinari and Ozieranski, 2019).

Economic:

The improving situation of the world’s economy is a significant boost for the pharmaceutical industry, which is having a phenomenal era (Ghasemi, 2019). The increasing trend of household spending and contended use of the pharmaceutical drugs are increasing abruptly, which is positively influencing the industry due to climbing prices. The current pandemic has increased the overall demand for pharmaceutical products across the globe, which shows USD 4.33 billion of incremental growth that uphold a 2.61% increase annually (Statista, 2021).

- This changing and transforming trend shows an opportunity for the pharmaceutical industry in the coming time to gain a significant and sustainable growth.

Social:

The world has seen a very dreadful recession caused by the pandemic, which has increased the health consciousness among the people (Kendall et al., 2020), which is clearly depicted by the ever-increasing consumption of drugs. The older generation in the current population is very huge in number, which has increased the consumption of the drugs and posed the pressure on the pharmaceutical industries across the globe, and after passing this generation, the consumption of the drugs may fall immediately. Similarly, global obesity is another factor that has emerged over a larger population due to the meteoric change of the global diet style, which is considered an epidemic in many economies.

- This rapidly increasing obesity among the people will directly increase the requirement of the drugs that will provide the significant growth to the pharmaceutical industry.

Technology:

The technological advancement in the pharmaceutical industry is clearly depicted by the Global R&D spending on the pharmaceutical industry; results are outrageous (Morgan et al., 2018). Globally USD 186 billion is spent on the R&D sector for the pharmaceutical industry as reported in 2019, and aims to target USD 230 Billion target by 2026 (Statistab, 2021).

- This enormous investment in biotechnology and the increasing market reach of the pharmaceutical industry can provide an opportunity to grow effectively.

Legal:

Although the TRIPS agreement for the protection of the intellectual property of the business effectively intervenes with the challenges in almost every country (Sahasranamam et al., 2019); however, the frauds in the pharmaceutical and healthcare sector are very common, which requires positioning of strict laws and regulations for careful investigation of the industry to prevent the fraud in the pharmaceutical sector. The cyber security of the pharmaceutical industry is another debated topic due to the outrageous increase in the data collection of patients and data breach cases. Hence, the investment for the risk assessment, evaluation and prevention is very necessary for this industry.

Environmental:

The pharmaceutical waste is the major concern of the companies due to the carbon footprint caused by manufacturing drugs.

- This mitigation of the carbon footprint problem requires an extensive cost for the mitigation of this challenge, which is very strenuous for the emerging companies.

- However, the companies can invest their assets in aligning the product strategy with the eco-friendly opportunities defined by the global sustainable development goals.

Porter’s Five Forces Analysis:

Porter (1980) provided a five forces-based internal analysis framework for identifying the structure and competitive strategy for the industry operations. These five forces include;

Threats of New Entrants (High):

Although the basis of the pharmaceutical industry is the investment in the R&D sector and the strict regulations/ restrictions on the sales of the drugs pose a challenge for the new entrants to the market. However, the increasing need of the pharmaceutical industry across the globe and the golden opportunity for the lower-cost generic manufacturing strategy has exploited enormous opportunities for the new entrants. Hence, the threat of new entrants in the market is very high.

Bargaining Power of Suppliers (Low):

The bargaining power of the suppliers in the pharmaceutical industry is low due to the well-established structure of this industry, which has limited the influence of the suppliers for the prices bargain. The chemicals are very much into account for this industry which increased the switching rate for the suppliers; hence, the incurrence of the high cost is negligible. Hence, the overall bargaining power of the suppliers in the global pharmaceutical industry is low.

Bargaining Power of Buyers:

The pharmaceutical industry is very much opposite to the other industries, and the buyers have a significant power who demands more by paying very less. Hence, the small customer base in the pharmaceutical has an enormous influence on the pricing strategy of the industry, and the enhanced ability to seek discounts and offers has resulted in the higher bargaining power of the buyers in this industry.

Threats of Substitute Products (High):

The threat of substitute products in the pharmaceutical industry is very high due to the enhanced competition between the industry giants, and it has also increased the industry competitiveness, which reduces the over-profitability of the industry. However, the key advantage of this increased threat of the substitute in the pharmaceutical industry thrives the sector as the demand also increases outrageously. Hence, the operations of AstraZeneca in the global market would be greatly influenced by this immense threat of substitute products in the market in a positive manner to further enhance the competitive advantage.

Competitive Rivalry (High):

The competition in the healthcare and pharmaceutical industry is very intense, which is due to the enhanced profitability for the organizations with the wide range of products. However, this immense and intense competition in the market has reduced the prices due, which results in very low profitability of the industry at other end. Hence, this competition, although not effects the short-term profitability of the companies but takes a role in the long-term profitability of the companies.

Internal Analysis-

Tangible Resources-

Physical Resources:

The physical resources of AstraZeneca are accounted to have a significant impact on its reputation across the different markets. The main physical resources of AstraZeneca are the development of facilities in several countries with having a total of 30 production and manufacturing sites in 20 different economies (Annual Report, 2021). However, the flawless supply chain network in the 100 countries with extensive retailing outlets network, the key physical resources provide a tangible competitive advantage.

Financial Resources:

AstraZeneca has a well-developed business venture in the international market and various portfolio products for numerous diseases; hence the financial resources of the company are enormous compared with other pharmaceutical companies. The annual revenues of AstraZeneca have increased with every passing year. Hence, this shows that the financial resources of AstraZeneca provide a sustainable competitive advantage over the competitors.

| Annual Revenues of AstraZeneca (USD millions) | |

| Year | Revenue |

| 2017 | $22,465 |

| 2018 | $22,090 |

| 2019 | $24,384 |

| 2020 | $26,617 |

Human Resources:

The total number of employees of AstraZeneca in the international market are over 76,100, as reported for the year 2020 (Statista, 2021). Similarly, the intellectual level of the employees of AstraZeneca is considered a significant element for maintaining a competitive advantage over the market. However, the turnover rate of the employees from 8.1 to 8.7 per cent by 2020 shows that the employees lack confidence and satisfaction of working in the company (Annual report, 2020). This is one of the phases that requires improvement from AstraZeneca.

Intangible Resources:

VRIO Framework:

| Resources/ Capabilities | Valuable | Rare | Imitable | Organization | Competitive Advantage |

| High customer rating | Yes, the high customer rating for the AstraZeneca is the major element that assists in growing the business | Yes, the high customer rating is very rare in this industry | Yes, the high customer rating is not easy to achieve or imitated by other competitors | Yes, the quality and diversification assured by AstraZeneca have significantly highlighted and helped in high customer rating | Realized Competitive Advantage |

| Huge brand awareness | Yes, the brand awareness in more than 100 countries is a major achievement of AstraZeneca | No, other competitors also have huge brand awareness in different economies | Yes, | AstraZeneca has invested enormous promotional resources to enhance brand reputation in its operational markets | Sustainable Competitive Advantage |

| Effective Leadership | Yes, the leadership of AstraZeneca has constantly supported the innovation and R&D sector (USD 6 Billion-2020), which provided sustainable growth to the company | Yes | No | Yes, the organization has always effectively managed and organized the process in a great manner | Competitive Advantage- Permanent |

| Intellectual employees | Yes, the employees of AstraZeneca are very intellectual and have effective competence and skills level | No | Yes | No | No Competitive advantage |

| Flexible Supply Chain Network | Yes, With operations in over 100 countries, AstraZeneca has a great flexibility in domestic and international supply chain network | No | The flexibility of the supply chain system can be easily imitated by the competitors | The flexibility is effectively utilized by AstraZeneca for its supply chain system | No Competitive advantage |

| Effective Pricing Strategy | Yes, The mix of skimming and competitive pricing of AstraZeneca is a valuable resource | No | Yes | Yes, the AstraZeneca has a pricing analytics engine | Competitive Advantage- Temporary |

| Presence in Global and Domestic markets | AstraZeneca has operations in over 100 countries with diverse target markets- Yes | The global presence of the brand in the pharmaceutical industry is a very rare feat, achieved by AstraZeneca- Yes | Requires enormous integration of resources; however, it can be imitated by the competitors | Yes | Competitive Advantage- Strong and Permanent |

| Portfolio Products and Synergy of various product lines | Yes, this industry is valuable, and portfolio products of AstraZeneca are also valuable | The lucrative segment is the new desire of the competitors-No | Yes | AstraZeneca has a very popular product portfolio which is effectively used by the firm- Yes | Requires constant innovation for long-term competitive advantage |

| Brand Positioning | Yes | No | It can be imitated by the other competitors of AstraZeneca, but it requires a significant market budget | Yes, the brand is purely based on the consumer behaviour | Competitive Advantage-Temporary |

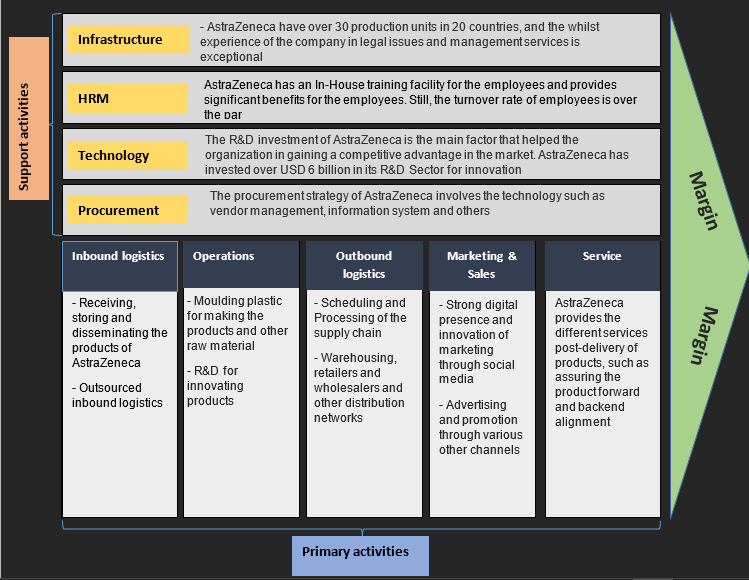

Value Chain:

The value chain analysis helps in assessing the strategic position of the company and investigating the key valuable resources of the organization.

Strategy Evaluation:

The venture of AstraZeneca in over 100 countries, including the UK market (Annual Report, 2021), is very much persistent with the development of the products. This shows that in the existing markets of AstraZeneca, the product development by means of innovation of new products (recently, the vaccination of Covid-19 and others) is the key strategy of AstraZeneca. Also, this refers to Ansoff’s matrix, which shows that AstraZeneca is focused on product development and investing over USD 6 billion in the R&D sector to innovate the products and services (Statista, 2020).

The evaluation of the strategy is based on the SAFe model or assessment, which provides the analysis of the internal competencies to adopt the changing strategy for the company to grow sustainably.

Suitability:

| TOWS Matrix | Internal Factors | ||

| Strengths – Huge brand reputation and awareness – Enormous investment in R&D – Extensive Financial resources – Developed market in over 100 countries | Weaknesses – Less employees’ satisfaction rate – Increasing uncertainty in the business approach of AstraZeneca – Less focus on the CSR and other department | ||

| External Factors | Opportunities – Very rapidly increasing market since the pandemic as sales increased by 10% – The developing markets are emerging in this sector – Continued focus of the market on innovation | SO O2+S1: Venture in developing markets O1+S4: Diversification opportunities O2+S3: Can attract customers of developing markets using the extensive promotional measures O3+S3: Can innovate the brand and get a competitive advantage in the pharmaceutical industry | WO |

| Threats – Strict rules and regulations by governments – Increasing complexity of the pharmaceutical industry – Reducing the trend of traditional marketing and sales in the pharmaceutical industry | ST | WT | |

The TOWS matrix for the suitability analysis shows that AstraZeneca should have to focus the market development strategy by different resources allocation for the market development and introducing the venture into the developing countries. Based on external factors, market development is, not very easy for the pharmaceutical industry due to highly strict rules and regulations of the governments, but AstraZeneca has a mighty experience of over 100 countries. Hence, the market development strategy in accordance with the Ansoff’s matrix is very much necessary for the AstraZeneca to develop in the market.

Acceptability:

The implementation of this new strategy for AstraZeneca will have a significant impact on two of the main stakeholders of the company with the strategy of the market development through expanding the venture in the developing economies will be; the Investors, Suppliers and Vendors

Power Interest Matrix:

| Level of Attention | |||

| Level of Power | Low | High | |

| Low | Minimal Effort | Keep Informed | |

| – Through the media and other promotional means, the AstraZeneca can maximize the chances of brand awareness in the developing market – The local communities can play a significant role in providing a sustainable acceptability through increasing the awareness in the community about the development | – Proper stakeholder engagement by informing the supporters and investors about how this strategy will help in enhancing the market for AstraZeneca – Upper and Lower tier suppliers and vendors about how the key processes will change for them | ||

| High | Keep Satisfied | Key Players | |

| – Keeping the active engagement of the government laws and regulations for the pharmaceutical industry of the developing economies – Local authorities to maintain the proper system of healthcare in the local market | – The key stakeholders of AstraZeneca that are directly or indirectly affected by the change in the strategy of the company in any situation – The two key stakeholders of AstraZeneca that would be impacted by this changing situation will be Investors and Suppliers/ Vendors of the company who are either directly or indirectly involved | ||

Feasibility:

As the network of AstraZeneca in the different economies is very effective and strong, that provides a sustainable and tangible competitive advantage over the competitors of the pharmaceutical industry. Hence, the financial resource and other resources of the company are well developed to bear the changing or transforming strategy. As the investment of over USD 6 Billion in the R&D sector has innovated new ways for the company (Statista, 2021), the financial resources of AstraZeneca are enough to adapt this new strategy. Similarly, the workforce of AstraZeneca is over 76,100 (Statista, 2021), which shows that the company can easily accommodate the new strategy by involving a diverse workforce for introducing the venture in the developing market. The intellectual employees, effective leadership, organized management, huge financial resource and an extraordinarily developed market are the key elements that can assure the success of this enhanced strategy proposed in accordance with the deep analysis of the internal and external environmental factors for the pharmaceutical industry and AstraZeneca.

References:

Porter, M.E., 1980. Industry structure and competitive strategy: Keys to profitability. Financial analysts journal, 36(4), pp.30-41.

Annual report 2020. AstraZeneca. (2020). Retrieved 1 April 2021, from https://www.astrazeneca.com/investor-relations/annual-reports/annual-report-2020.html.

Statista. 2021. AstraZeneca employees by region 2020 | Statista. [online] Available at: <https://www.statista.com/statistics/266558/astrazenecas-employee-distribution-by-region-since-2008/> [Accessed 1 April 2021].

Morgan, P., Brown, D.G., Lennard, S., Anderton, M.J., Barrett, J.C., Eriksson, U., Fidock, M., Hamren, B., Johnson, A., March, R.E. and Matcham, J., 2018. Impact of a five-dimensional framework on R&D productivity at AstraZeneca. Nature Reviews Drug Discovery, 17(3), p.167.

Statistab. 2021. Global pharmaceutical R&D spending 2010-2024 | Statista. [online] Available at: <https://www.statista.com/statistics/309466/global-r-and-d-expenditure-for-pharmaceuticals/> [Accessed 1 April 2021].

Sahasranamam, S., Rentala, S. and Rose, E.L., 2019. Knowledge sources and international business activity in a changing innovation ecosystem: A study of the Indian pharmaceutical industry. Management and Organization Review, 15(3), pp.595-614.

Mulinari, S. and Ozieranski, P., 2018. Disclosure of payments by pharmaceutical companies to healthcare professionals in the UK: analysis of the Association of the British Pharmaceutical Industry’s Disclosure UK database, 2015 and 2016 cohorts. BMJ open, 8(10), p.e023094.

Ghasemi, M., 2019. Regulatory Challenges in Pharmaceutical Industry: An Economic Analysis.

Kendall, E., Ehrlich, C., Chapman, K., Shirota, C., Allen, G., Gall, A., Kek-Pamenter, J.A., Cocks, K. and Palipana, D., 2020. Immediate and Long-Term Implications of the COVID-19 Pandemic for People With Disabilities. American Journal of Public Health, 110(12), pp.1774-1779.

Appendix: