The impact of political or economic decisions on stock markets: Turkey from 1994-present

Author: Jamie Walker

At: July 19, 2023

Abstract The aim of this study was to empirically evaluate how the Turkish stock market, Borsa Istanbul, is affected by political and economic decisions made by the government in Turkey. The time series historic monthly data for the variables of political and economic decisions of the Turkish government for 27 years, starting from January 1994 to December 2020, was collected from Trading Economics and Bloomberg website database. The data was analysed using multiple regression analysis where one political variable, namely; Geopolitical Risk Index indicating the level of geopolitical risk in Turkey, and three economic variables, namely; Real Effective Exchange Rate indicating Turkey’s currency exchange stability, Consumer Price Index indicating the rate of inflation, and Discount Rate indicating the interest rate used in money market instruments in Turkey, were used. The Turkish stock market XU100 Index was used as the dependent variable to measure the Turkish stock market performance. The results of the multiple regression analysis depicted that the impact of the Geopolitical Risk Index was insignificant on XU100 Index. It means if geopolitical risk in Turkey increases, then it will insignificantly impact the performance of the Turkish Stock Market. In simple terms, the geopolitical risk in Turkey is not likely to bring any significant change in the XU100 index. However, the impact of the Consumer Price Index, Real Effective Exchange Rate, and Discount Rate was significantly negative on XU100. It means if Turkey’s currency exchange stability based on REER, rate of inflation based on the Consumer Price Index, and rate of interest based on the Discount Rate in Turkey increases, then, it will significantly decrease the performance of the Turkish Stock Market in terms of reducing the XU100 index. Therefore it was concluded that the Turkish stock market, Borsa Istanbul, could be affected negatively by economic decisions made by the government in Turkey in terms of increased inflation, increased interest rate, and increased currency exchange stability. However, the Turkish stock market, Borsa Istanbul, is not significantly impacted by the political decisions made by the government in terms of increased geopolitical risk.

1.0 Introduction

1.1 Background

Turkey is a country with political tension and poor economic decision-making. The political decisions, government foreign policies, events like terrorist attacks, and political tension in Middle-east may have a negative impact on its stock market index (Gok & Dayi, 2018). Moreover, the Turkish economy has experienced unusual events in the past years; for instance, in August 2018 the exchange rate crisis occurred, which was mainly caused by the humiliating speech of the then Minister of Finance Berat Albayrak, the coup attempt in 2016, the controversial referendum of the one-man regime in 2017, the finding of natural gas in the Black Sea in 2020, the Gezi Park protests and many more events that had major impacts on stock returns (Tiryaki & Tiryaki, 2018; Oguz, 2020). In this regard, the aim of this study is to answer the research question, which is focused on empirically evaluating how the Turkish stock market, Borsa Istanbul, is affected by political and economic decisions made by the government in Turkey using monthly data starting from January 1994 to December 2020. Historic data for the variables of the political and economic decisions are statically analyzed using a model equation to conclude how stock markets are impacted by their respective impacts. The value-addition of this study is in terms of expansion of the existing literature and filling the gap by providing the latest empirical research findings regarding the impact of the political and economic variables on stock returns of the stock market of Turkey, which is an emerging economy. This study covers 27 years of data, and so it provides a comprehensive study to understand the behaviour of the stock market of Turkey.

1.2 Motivation for the Research Question

Stock market performance can be influenced by various factors, including changes in the macro-environment of a country, such as political and economic policies and decisions made by the country’s government. Stock market reactions to the political and economic decisions have been of interest to researchers, investors, companies, and policymakers (Gok & Dayi, 2018). It is important for investors to identify how the change in government political and economic policies can have varying impacts on the stock market indexes and how it can drastically change the sentiments and trading in the stock market (Günay, 2016). Various studies have been conducted around the world, including Turkey, to evaluate how stock markets can be impacted by the political and economic decisions of Aktas and Oncu (2006), Mehdian, Nas, and Perry (2005), Çam (2014), Günay (2016), Gok and Dayi (2018), Tiryaki and Tiryaki (2018). However, limited evidence is found where both the political and economic decisions are studied in single research, especially in Turkey, to identify their impacts on the stock market index. Only one study was found in the literature, which was conducted by Tiryaki and Tiryaki (2018), where the impacts of political and economic decisions on the stock market index were studied in single research in Turkey. In view of this, the proposed study is of great importance because it aims to evaluate how the stock market index is affected by political and economic decisions in Turkey.

Turkey’s political and economic environment has been unsteady due to its government’s foreign policies, coup attempts, a dispute over Black Sea control, terrorist attacks, Gezi Park protests and unfriendly political relationships with the USA and Arab countries (Gok & Dayi, 2018; Oguz, 2020). Moreover, the economic performance of the country has been hampered due to financial turbulences and exchange rate problems in the past years (Oguz, 2020). Therefore it is worth investigating the impact of these political and economic decisions on the stock returns of the Turkish Stock Market. In view of this, it is of value to empirically test how political events and economic decisions have affected the stock market index in Turkey.

3.0 Literature Review

A review of the past empirical studies conducted in Turkey is provided in this section, where those studies have been reviewed in which the impact of variables of political decision or policy and the economic policy on stock market variables were studied. This section will help in identifying the suitable variables and the analysis methods which can be used in this proposed study to measure the impact of political events and economic decisions on the stock market index in Turkey. The studies which have been included in the review were conducted in the last 15 years. Therefore, any study which was conducted earlier than 2005 will be excluded, and it will be the exclusion criteria for the past studies.

A study on the macroeconomic variables impacting the stock market prices of Turkey BIST100 index (BIST) was conducted in 2018 by Tiryaki and Tiryaki. It found that the index is negatively impacted by changes in the interest rate (R) in Turkey. Other macroeconomic factors positively impact the index returns in the short run, such as the real effective exchange rate (RER), Consumer Price Index (CPI) and the Industrial Production Index (IPI). These results were found using ARDL estimation methods. The study showed that in the long-run, stock returns of BIST are determined by changes in CPI, EPU, RER and IPI.

The impact of political decisions on the Turkish stock exchange was studied by Aktas and Oncu (2006). From the research, it was found that stock prices are inversely related to any negative political event in Turkey. The study was based on the theory of Efficient Market Hypothesis (EMH), which assumes that equity market prices are based on all available information, with new data immediately incorporated into the stock prices. Price declines during fluid political environments provide the perfect opportunity to test the validity of EMH. The authors used day-wise data and OLS analysis to study pre and post-impact of a turbulent political event in Turkey. This event on March 1, 2003, when the Turkish parliament unexpectedly rejected a bill for the deployment of US military personnel in the country, led to steep declines in the Turkish stock exchange IMKB. Hence the authors using data from this event, concluded that surprising political decisions put stress on the financial market, with the participants losing rationality to critically assess the actual impact of the event.

Another study in Turkey by Mehdian, Nas, and Perry (2005) evaluated the forecast of two different theories on stock market reactions to political or economic events in the country. It found that the Turkish market, in the face of ambiguity, adjusted prices below fundamental stock valuations. Another study by Cam (2014) found a major relationship between Turkish company valuations and political uncertainty in the country. Kaya et al. (2015) also found that returns on the BIST100 index are inversely related to political risk in the long term horizon.

Gok and Dayi (2018) based their study on the impact on market returns during Turkish general elections. Since elections are a source of political uncertainty, the study is highly relevant to our analysis. Gok and Dayi (2018) used the event study analysis of three general elections in Turkey taking place from 2010 to 2017. Results from the study found that the June 2015 elections had a major negative impact on the Turkish stock market due to the breakdown in talks to develop a coalition government after the election. However, the market reacted positively once new elections were held in November 2015. This leads to the conclusion that even though the impact of elections on the stock market is obvious, however, their scale of the effect is short-lived. This short-term volatility was also revealed in the GARCH (1.1) model results.

Evidence presented in the study by Bilson, Brailsford, and Hooper (2002) highlighted that in the emerging stock markets returns, some variation might be explained by political risk both at the level of aggregate portfolio and the country. The findings of the study revealed that in individual emerging markets, the return variation is significantly explained by political risk, not in the developed markets but especially in the Pacific Basin.

The study of Dar-Hsin, Feng, and Chun (2005) investigated the potential influence of political events on the prices of the stock market in Taiwan. Moreover, the study found that with a certain exception, price responses among most political developments are negligible, meaning that certain events are essentially uninformative. The abnormal return habits of companies, including small and significant foreign institutional ownership, are often comparable.

Le and Zak (2006) in their study formulated a model of portfolio choice in which capital flight is associated with risk aversion, return differentials, and three forms of other risks such as political uncertainty, policy variability, and economic risk. They discovered that these three forms of risk have a statistically significant effect on capital flight after measuring the equilibrium capital flight equation for a panel of 45 developed countries throughout a 16-year period. The study also discovered that political uncertainty is the most significant factor correlated with capital flight, and many political factors, presumably by signalling the implementation of market-oriented adjustments, minimise the capital flight.

Kesternich and Schnitzer (2010) investigate the impact of political threats on the capital structure of multinational firm’s global affiliates. As per the findings, with an increase in political risk, ownership rate declines and leverage increases or decreases based on the form of political risk. Şanlısoy and Kök (2010), in different research, analyse a negative relationship between political instability on economic growth.

kizlerli and Ülkü (2011) by utilising the quantified ratings of political risk published by ICRG and the international flows data collected by the Stock Exchange of Istanbul. The study examines the relationship between the behaviours of foreign investors and political risk. The study revealed that in upgraded economies, political risk has a low and slow impact, and on downgraded economies, it has an immediate impact. The study also stated that the tourism industry is more vulnerable to political concerns than other industries.

Through estimation, Baldacci, Gupta, and Mati (2011) evaluated the country risk premiums determinants for 46 emerging economies markets and concluded that on country risk premiums, fiscal and political risks have a substantial impact. Baek and Qian (2011) analysed that if the political risk has the same impact on developing and emerging states or not, findings show that since 9/11, it has become a more important factor in foreign direct investments. Vadlamannati (2012) analysed the US firm’s investment in 101 different states and discovered an association between increasing profitability and low political risk level.

Further studies by Günay (2016) on the effects of internal political uncertainty on the Turkish stock market found similar relationships. The implications of internal political danger on the Turkish stock market were studied using data from 2001-2014. The study made an empirical analysis to identify breaks and regimes in the returns of the BIST100 index. Results from the analysis found that although breaks in the market are higher in frequency, however, the risk level is continuously moving towards a downward trend. Hence the trend is towards a lower risk level today than in previous regimes. This leads to the conclusion that although the Turkish market continues to react to political changes, however, the impact of those reactions is lower than in the past. Therefore, Günay concluded that the stock market of Turkey reacts to political developments, although not as strongly as in previous years.

As per the study by Khan and Khan (2018), macroeconomic variables have a significant impact on investment decisions, as shifts in macroeconomic variables affect financial markets differently depending on the country’s government policies and economic conditions. Through evaluating month-wise data from May 2000 to August 2016, the research contributes to determining the impact of several macroeconomic variables on Pakistani stock prices. The ideal ARDL method of bound testing is used to verify the long and short-term co-integration of macroeconomic variables on stock prices since both variables are stationary at first difference. The results indicate that the exchange rate, interest rate, and money supply have a substantial impact on Karachi Stock Exchange’s stock prices over time. Except for the exchange rate, which is adversely co-integrated with stock prices, and all factors are irrelevant in the short term. When adjusting the money supply in the economy, the central bank must be cautious because an excessive rise in supplying money can have an impact on investment and the stock market. To promote economic activity, the regulator must maintain interest rate stability while avoiding discretionary initiatives and strengthen the external environment of the economy with the policy of a rule-based exchange rate.

Investors switch to bonds when an increase in interest rates is observed, indicating that there will be a fall in the stock prices. Conversely, the prices of stocks will rise with a fall in interest rates (Peiro, 2015). Discount rate increases with an increase in the interest rate, resulting in a reduction in the current value of potential cash flows, which is supposed to have a negative impact on the prices of stock (Hasan and Nasir, 2008).

Although, some research, such as Lobo (2002) and Erdem, Arslan, and Erdem (2005), identified a favourable association with the interest rates of several stock markets. These studies clarified that if the Federal Reserve increases interest rates more/less than anticipated, it is considered bad/good news for the stock market. Bad news seems to have an influence on the stock market, although the impact of interest rates is positive.

Sonmez (2007) found evidence that Turkish stock market volatility is impacted by a high inflation rate. Moreover, Tiwari et al. (2015), while utilising the wavelet coherency techniques and wavelet phase angle, thoroughly analysed the relationship between inflation and stock prices in Pakistan. Based on the aggregate results of inflation measures such as the price index of consumers and the price index of producers, the analysis concluded that inflation has no effect on the estimation of the stock price in Pakistan and also that stocks can be used as a long-term inflation shield. Currency is frequently used in asset portfolios as a form of investment. Furthermore, awareness of the exchange rate and its impact on the stock market is critical for fund portfolio performance. The impact of exchange rate movements on stock prices has been studied with mixed results. Diamandis and Drakos (2011) established a positive impact of the exchange rate on the prices of stock. However, the adverse impact was determined by Bekhet and Mugableh (2012). Depreciation that increases the competition of local companies is an instance of this positive impact, resulting in increased exports and, therefore, higher stock prices (Muhammad & Rasheed, 2002).

Kartal, Depren, and Depren (2020) identified that due to the existence and spread of the coronavirus pandemic across the globe, the level of uncertainty has increased for the entire world. Foreign portfolio investment outflows from stock markets have had a negative impact on developing economies, and major indices of the stock exchange have crashed as a result of this situation. Throughout the period of COVID-19, the research investigates the factors that influenced Turkey’s main stock exchange index adjustments. The findings of the study proved that the most significant variables were credit default swap spreads, foreign investor retention, government bond interest rates, volatility index throughout the period before the pandemic, and Morgan Stanley Capital International (MSCI) index of emerging markets.

The variables used identified in the past studies were evaluated to determine which of them could be used as measures of political and economic variables so that they can be used as predicting variables to evaluate their impact on the stock market index in Turkey.

3.0 Data and Methodology

3.1 Data

Time series data were collected for the selected variables of the Turkish stock market, political decisions and economic decisions. The historic (time series) data for the monthly XU100 index was collected for a period of 27 years (from January 1994 to December 2020) from the Trading Economics and the Bloomberg website database. Moreover, the monthly data for the variables of political decisions, Geopolitical Risk Index (GPR), was collected from the data based found on Economic Policy Uncertainty website. However, the monthly data for the selected measures of economic decisions, namely, Real Effective Exchange Rate (REER), Consumer Price Index (CPI), and Discount Rate (DR), was collected from the Bloomberg website database. The data for the selected variables was collected for 27 years (from January 1994 to December 2020).

3.2 Dependent and Independent Variables

In this section, the independent (predicting) variables and dependent variables and their measures and symbols are discussed. As the aim of this study is to evaluate the effect of political and economic decisions by the Turkish government on the Turkish stock market therefore, the main variables of this study include; political decisions, economic decisions, and the performance of the Turkish Stock Market Index.

The dependent variable of this study is the Turkish Stock Market Index, where the Borsa Istanbul 100 Index (XU100) was used as a measure of the Turkish Stock Market Index.

Two main independent variables were used in this study political decisions and economic decisions; where one variable, namely; Geopolitical Risk Index (GPR) for Turkey, was used as a measure of political decisions. However, three variables, namely; the REER for Turkey, CPI for Turkey, and DR for Turkey, will be used as measures of economic decisions by the Turkish government. The CPI was also used by Tiryaki and Tiryaki (2018) while analyzing the impact of political and economic variables on stock returns of the Turkish stock market. The GPR is a measure of the number of new articles present in reach newspapers related to geopolitical risk in a country. The variables used, their sources, and their symbols are denoted in the following table 1.

Table 1. Variables Used

| Variables | Sources | Measures | Symbol | |

| Dependent Variable | Turkish Stock Market Index | Trading Economics, Bloomberg | Borsa Istanbul 100 Index | XU100 |

| Independent Variable | Political decisions | Economic Policy Uncertainty | Geopolitical Risk Index | GPR |

| Independent Variable | Economic decisions | Bloomberg | Real Effective Exchange Rate | REER |

| Bloomberg | Consumer price index | CPI | ||

| Bloomberg | Discount rate | DR |

The results of this study may be similar to that of Tiryaki & Tiryaki (2018) because the similar variables were used in this study. How the results of this study will be different than that of Tiryaki & Tiryaki (2018) because in the present study, latest data will be used, while discount rate was used instead of interest rate, and so the impact of the political and economic variables on stock returns of the Turkish stock market during last 2 years may have been different.

3.3 Methodology

The political and econometric data was collected and analyzed in this study therefore, and a regression model is to be developed to analyze how the Turkish stock market index is affected by political and economic decisions made by the government in Turkey. The monthly data for the selected variables of Turkey were analyzed for 27 years, from January 1994 to December 2020, using statistical software known as EViews. As the data was time series, therefore regression model for time series analysis was developed, and the regression analysis was performed to evaluate the causal relationship (Field, 2013). Using the variables of political and economic decisions of the government in Turkey discussed in the previous section, the following regression-based equation model was developed, which was statistically tested in this dissertation.

XU100 = 𝛽C + 𝛽(GPR) + 𝛽(REER) + 𝛽(CPI) + 𝛽(R) + 𝜀

Where;

C = Constant

𝛽 = Coefficient of predicting variables

𝜀 = Error term in the model

A quantitative research method was employed to statistically conduct the regression analysis (Bryman & Bell, 2015). Moreover, as this study involves the impact of variables (political and economic decisions) on another variable (the Turkish stock market), therefore, causal research design and positivist research philosophy were employed to conduct this study. As per Field (2013), regression analysis is appropriate to select as a data analysis method when causal relationships between two or more variables are to be tested. As per the literature, when more than two predicting variables are there, then multiple regression analysis is employed (Field, 2013). Therefore, multiple regression analysis will be employed because the impact of four predicting variables on one dependent variable is to be tested. As per Saunders, Lewis, and Thornhill (2012), causal research design and positivist research philosophy is appropriate to use in line with the quantitative research method. The regression model was statistically tested using the time-series regression analysis in EViews because the data which was used in this study is time series (Field, 2013). The time series regression analysis was used to test the following null hypotheses;

H01: Geopolitical Risk Index (GPR) has a significant negative impact on Turkish Stock Market Index (XU100)

H02: Real Effective Exchange Rate (REER) has a significant negative impact on Turkish Stock Market Index (XU100)

H03: Consumer price index (CPI) has a significant negative impact on Turkish Stock Market Index (XU100)

H04: Discount rate (DR) has a significant negative impact on Turkish Stock Market Index (XU100)

4.0 Data Analysis and Discussion

4.1 Introduction

In this chapter, the time series data is statistically analysed using EViews to identify the impact of the variables of political and economic decisions on Turkish stock market performance based on XU100. The multiple regression analysis was used to test the impact of political and economic decisions on XU100. Moreover, the four hypotheses are tested by conducting multiple regression analyses. In addition, descriptive statistics and parametric tests are also performed on the dataset. The results are summarised in tables, while full Eviews outputs are shown in the Appendices section.

4.2 Descriptive Statistics

First of all, on the dataset, descriptive analysis was performed to identify the mean (average), median, maximum, minimum values and number of observations of the variables of political and economic decisions and the XU100 index. The results of the descriptive analysis are shown below.

Table 4.1 Descriptive Statistics

| GPR TURKEY | Interest rate (Discount rate) | Real Effective Exchange Rate (REER) | TURKEY CPI | XU100 | |

| Mean | 113.4484 | 32.78781 | 97.67972 | 31.82580 | 439.8003 |

| Maximum | 251.8664 | 79.00000 | 127.7200 | 130.6000 | 1476.720 |

| Minimum | 44.10559 | 8.750000 | 60.52000 | 3.990000 | 1.410000 |

| Observations | 324 | 324 | 324 | 324 | 324 |

As per the results, the number of observations for all the variables was 324; this shows there was no missing data. The mean, maximum, and minimum values for Turkey’s GPR shows that during the last 27 years, from 1994 to 2020, on average Turkey’s GPR value was found to be 113.44; however, the maximum GPR value was 251.86, and the minimum value was 44.10. This indicates that Turkey’s GPR value has been fluctuating significantly during this period. Moreover, during the last 27 years, the average DR value in Turkey was found to be 32.78, while the maximum DR value was 79 and the minimum value was 8.75. This shows also shows that the DR in Turkey has been fluctuating significantly during the last 27 years. Similarly, the mean, maximum, and minimum values of REER, CPI and XU100 index of the Turkish stock market were found to have been fluctuating significantly from 1994 to 2020. It was found that the XU100 index of the Turkish stock market, on average, was at 439.80 points between 1994 and 2020.

4.3 Multiple Regression Analysis

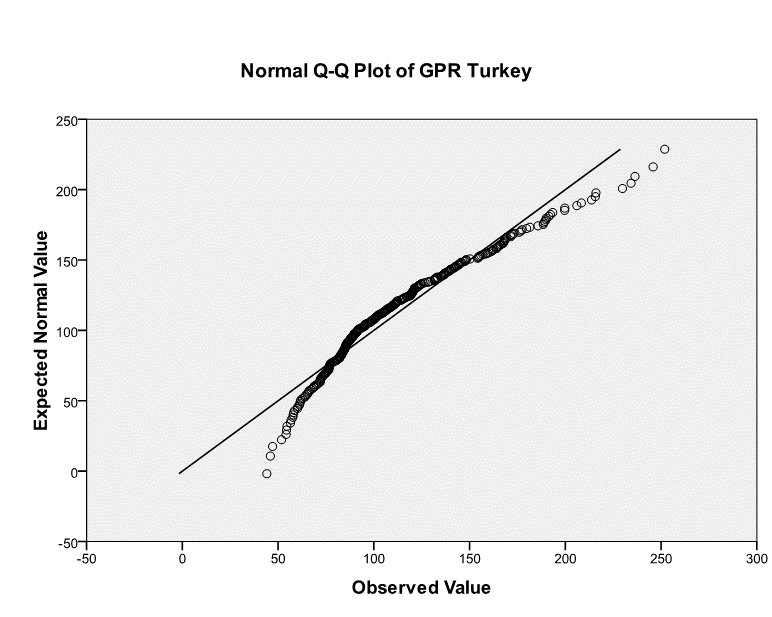

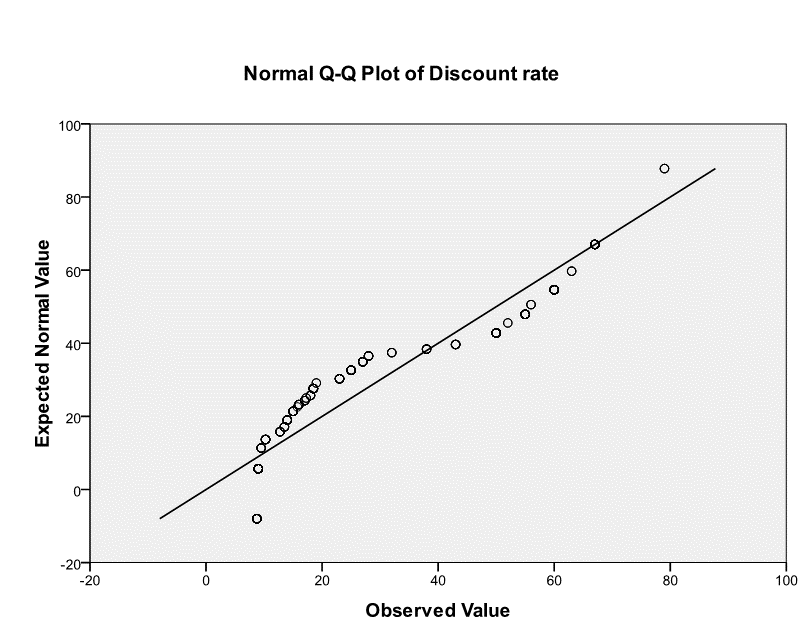

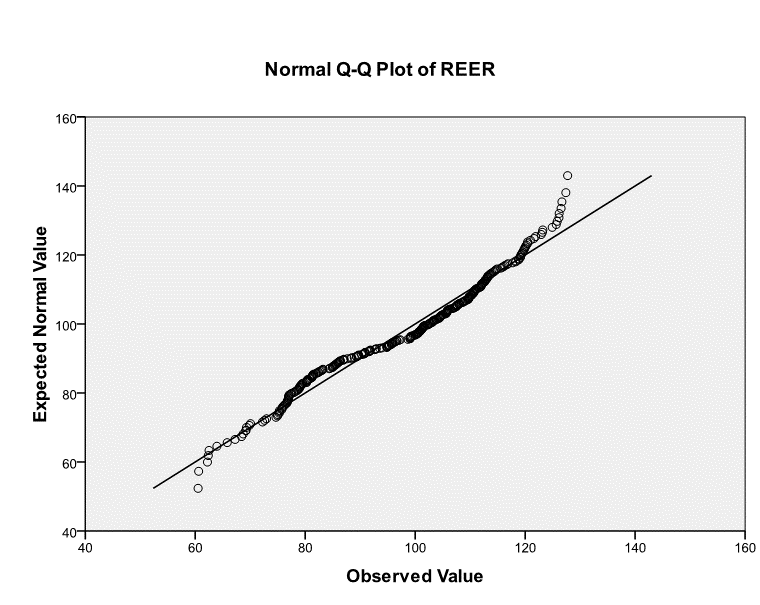

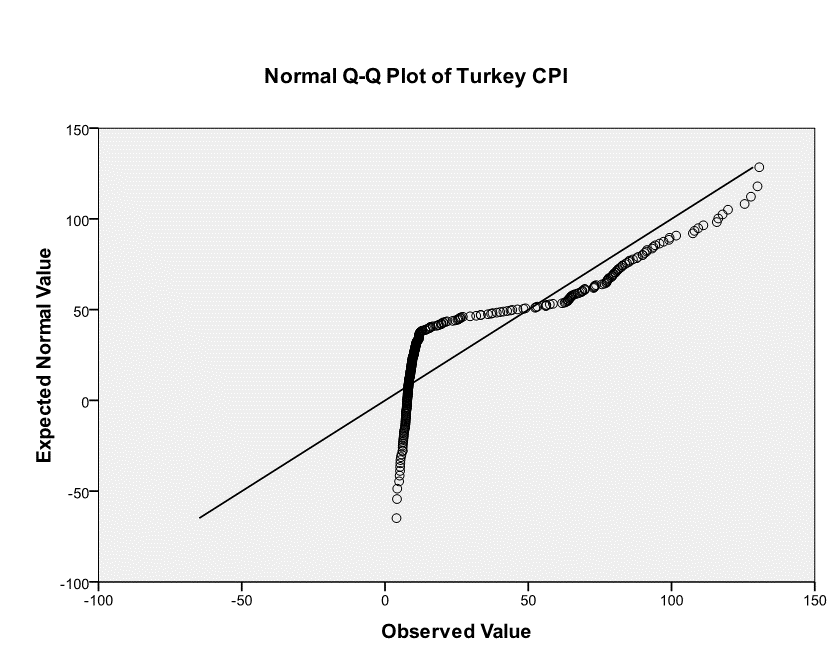

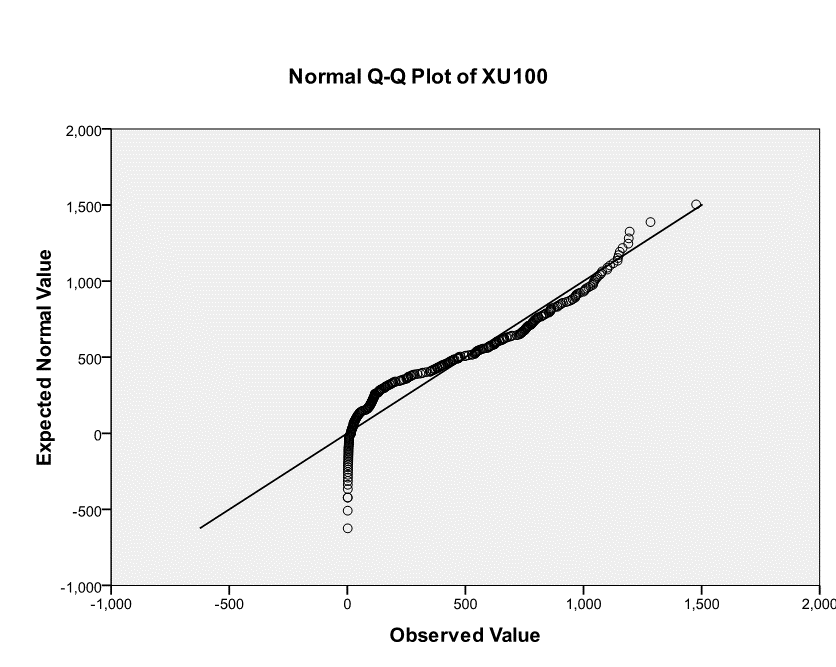

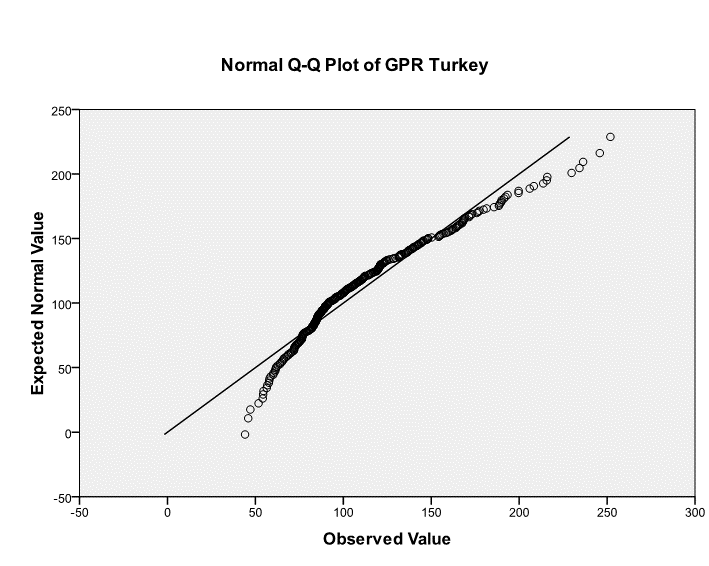

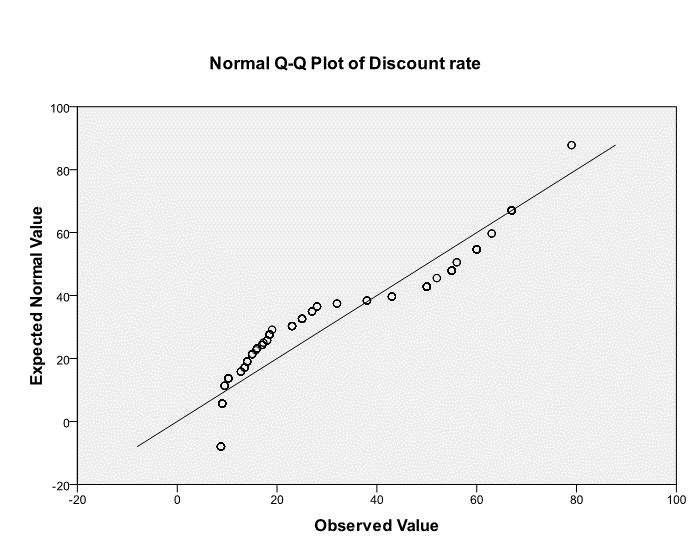

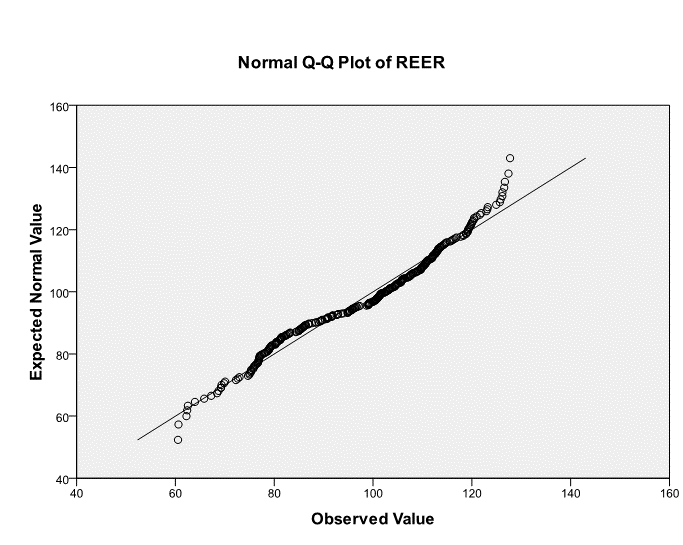

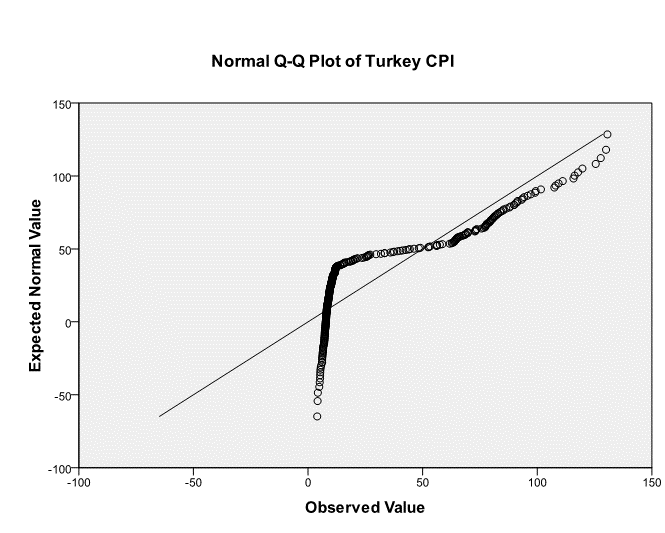

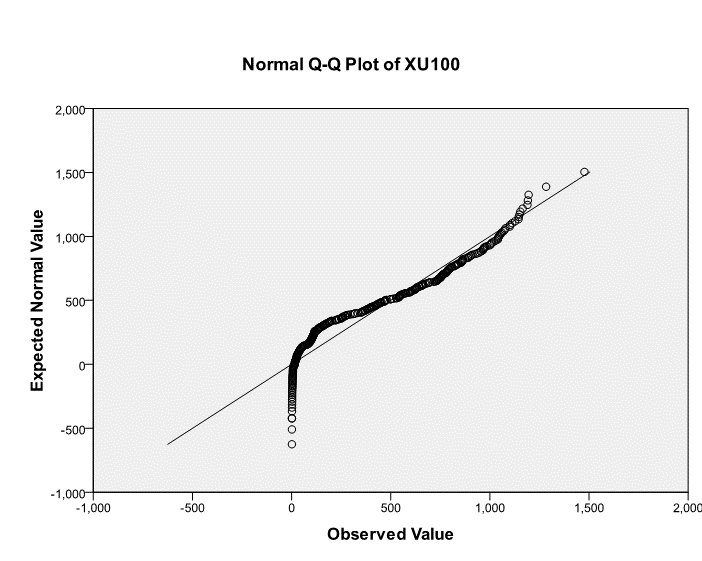

The dataset used in this study was based on time series because no cross sections were involved, and 27 years of monthly data for the variables of the Turkish stock market, political decisions and economic decisions in Turkish was used. When regression analysis is applied to time series data, it is necessary to satisfy that; the data is normally distributed, there is no Autocorrelation present between the observations due to time lag, there is little or no Multicollinearity present, and there is no Heteroscedasticity present in the data. Therefore four parametric tests were conducted to satisfy the assumptions that the data was normally distributed and there is no Autocorrelation, Multicollinearity, and Heteroscedasticity present in the dataset. First of all, the normality analysis was conducted to ensure that data was normally distributed. The normal Q-Q plot of the XU100 index and the predicting variables are shown below in figures 4.1, 4.2, 4.3, 4.4, and 4.5, respectively.

Figure 4.1 Normality of GPR Turkey

Figure 4.2 Normality of Discount Rate (DR)

Figure 4.3 Normality of REER

Figure 4.4 Normality of Turkey’s CPI

Figure 4.5 Normality of XU100

As the data plots for the five variables, XU100, GPR, CPI, REER, and DR, were slightly deviated from the central lines, therefore the dataset was normally distributed for all the variables, and it satisfied the first requirement of a time series regression analysis.

Subsequently, the absence of Autocorrelation was tested by applying the Durbin-Watson test, where the Autocorrelation between the observations due to time lag was measured on the basis of the Durbin-Watson value. As per the literature, if the Durbin-Watson value is around 2, then there is no Autocorrelation present between the observations (Field, 2013). The Durbin-Watson stat was found to be 1.871, and so as the value was around 2, therefore Autocorrelation was not found to be present between the observations. This satisfies the second condition of using regression analysis.

Afterwards, the presence of Multicollinearity was checked on the basis of VIF value while conducting the multiple regression analysis. It was stated by Menard (1995) and Hahs-Vaughn (p. 151, 2016) that “Tolerance values less than .10 and VIF values greater than 10 indicate multicollinearity.” Therefore as per the literature, if VIF is less than 10, then there is no Multicollinearity present in the data. The VIF values of the variables are shown below in Table 4.2.

Table 4.2 Multicollinearity Test

| Collinearity Statistics | |

| VIF | |

| GPR Turkey | 1.138 |

| Discount rate | 3.728 |

| REER | 1.543 |

| Turkey CPI | 4.700 |

a. Dependent Variable: XU100

The analysis of the results shows that the VIF values of all the variables were greater than 1 and less than 10, and therefore, no Multicollinearity was found to be present in any of the studied variables.

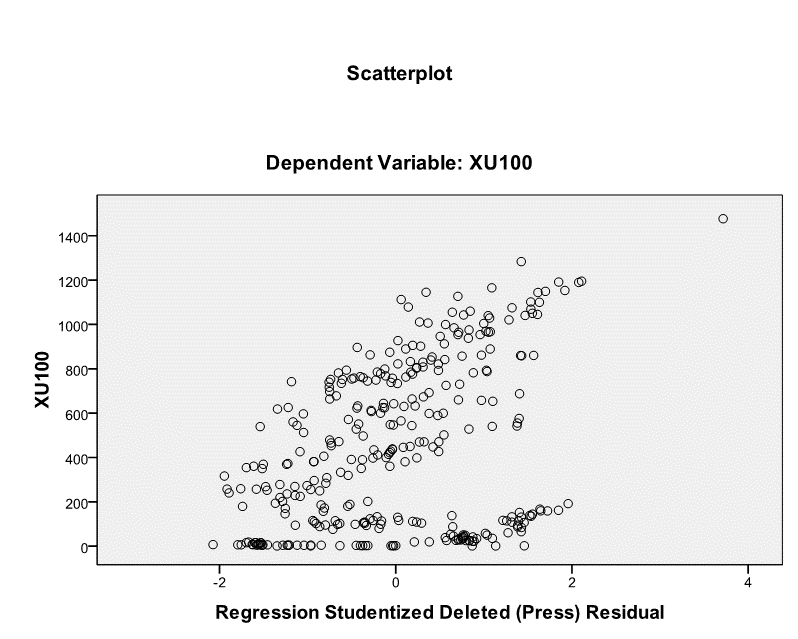

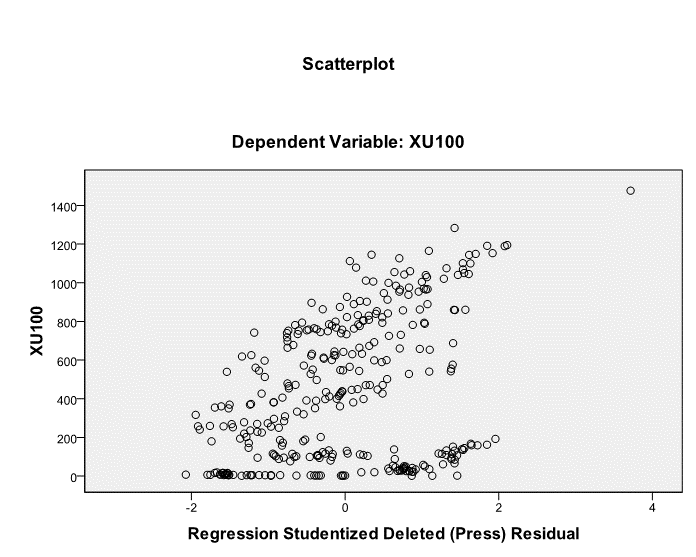

Moreover, the presence of Heteroscedasticity was measured on the basis of Scatter plot graph in regression analysis. As per the literature, if the dots on the scatter plot do not form a specific pattern, then there is no Heteroscedasticity present in the data (Field, 2013). The Scatter plot graph shown below in Figure 4.6 it was found that the dots on the scatter plot do not form any specific pattern; therefore, no Heteroscedasticity was found to be present in the dataset.

Figure 4.6 Scatter plot to test Heteroscedasticity

As all the conditions for the validity of regression analysis were satisfied, therefore, it was appropriate to conduct multiple regression analysis on the dataset to evaluate the impact of the political and economic variables in Turkey on the Turkish stock market index. At 95 per cent confidence interval, the summarised results of the multiple regression analysis are covered in the following table.

Table 4.3 Regression Analysis

Dependent Variable: XU100

Date: 04/22/21

Sample: 1994M01 2020M12

Included observations: 324

Sig. Coefficient Adjusted R2

Prob(F-statistic) 0.000 0.8549

GPR 0.058 0.398

REER 0.000 -7.747

CPI 0.000 -2.161

DR 0.000 -13.592

First of all, the fitness of the regression analysis on the time series data was tested by analysing the results given in table 4.3 above. As per Field (2013), if the sig. value of regression analysis based on F-statistics is less than or equal to 0.05, then the analysis is considered to be fitted significantly on the dataset, and the regression analysis is statistically appropriate. Based on the adjusted R2 value, the variation in the dependent variable (which is XU100) due to the four independent variables was evaluated. The results indicate that the model was fitted significantly on the time series data as sig. value of the regression Prob(F-statistic) was 0.000. Hence it was less than 0.05. The adjusted R2 value was 0.8549, which means that around 85.49 per cent variation in the dependent variable (XU100) was due to the four independent variables used in the analysis.

Afterwards, the sig. and Coefficient values of all the predicting variables used in the regression analysis were analysed to identify which of the political and economic variables in Turkey can have significant impact on Turkish stock market index. If sig. value of the independent variable was less than or equal to 0.05, then its impact was significant; however, if the coefficient value of the independent variable was positive or negative, then its impact was also positive or negative on the XU100 index. The results depict that the impact of GPR was insignificant on XU100 as its sig. value was 0.058, which was greater than 0.05. However, its value of coefficient was found to be 0.398, which indicated that the direction of the impact of the GPR of Turkey on the XU100 index was positive but insignificant. Therefore it was evident that the Geopolitical Risk Index of Turkey has an insignificant impact on the XU100 index.

The results further show that the impact of DR was significant on XU100 as its sig. value was 0.000, which was less than 0.05. However, its value of coefficient was -13.59, which depicts that the direction of the impact of DR of Turkey on the XU100 index was negative. Therefore it was evident that the discount rate of Turkey has a significant negative impact on the XU100 index.

Moreover, the impact of REER was found to be significantly negative on the XU100 index because its sig. value was 0.000, and its value coefficient was -7.747. Therefore the Real Effective Exchange Rate of Turkey has a significant negative impact on the XU100 index. Similarly, the impact of Turkey’s CPI on the XU100 index was found to be significantly negative because its sig. value was 0.000, and its value coefficient was -2.161. Therefore, the Consumer Price Index of Turkey has a significant negative impact on the XU100 index.

4.4 Testing of Hypotheses

The four null hypotheses were tested on the basis of the finding of the multiple regression analysis discussed above. The Hypotheses Testing Summary table given below shows which of the null hypotheses were found valid and invalid.

Table 4.4 Hypotheses Testing Summary

| Hypotheses | Coefficient value | Sig. level | Empirical Conclusion |

| H01: Geopolitical Risk Index (GPR) has a significant negative impact on Turkish Stock Market Index (XU100) | 0.398 | 0.058 | Invalid |

| H02: Real Effective Exchange Rate (REER) has a significant negative impact on Turkish Stock Market Index (XU100) | -7.747 | 0.000 | Valid |

| H03: Consumer price index (CPI) has a significant negative impact on Turkish Stock Market Index (XU100) | -2.161 | 0.000 | Valid |

| H04: Discount rate (DR) has a significant negative impact on Turkish Stock Market Index (XU100) | -13.592 | 0.000 | Valid |

As per the findings, the Geopolitical Risk Index (GPR) has an insignificant impact on the Turkish Stock Market Index (XU100), therefore, based on this finding, the null hypothesis 1 (H01) was proven invalid. The GPR was not found to have an insignificant impact on the Turkish Stock Market Index. However, as per the findings of regression analysis, the remaining null hypotheses (H02), (H03), and (H04) were proven valid. The findings depicted that the three economic variables in Turkey, REER, CPI, and DR, have a significant negative impact on the Turkish Stock Market Index (XU100). In line with the results, the insignificant variable (GPR) from the regression-based equation model is removed, and the final equation model becomes as follows.

XU100 = 𝛽C + 𝛽(REER) + 𝛽(CPI) + 𝛽(R) + 𝜀

It means if the geopolitical risk in Turkey increases, then it will insignificantly impact the Turkish Stock Market Index (XU100), while if REER, CPI, and DR in Turkey increase, then, it will significantly decrease the Turkish Stock Market Index (XU100). These findings are in line with the findings of Tiryaki and Tiryaki (2018), who also found that the XU100 index is negatively impacted by changes in the interest rate in Turkey. However, the findings contradict the findings of Tiryaki and Tiryaki (2018) because they have found that other economic variables like REER and CPI positively impact the XU100 index in the short run.

Moreover, the findings of this study are also in contrast with the findings of Aktas and Oncu (2006) regarding the impact of political decisions on the Turkish stock exchange. Aktas and Oncu (2006) found that Turkish stock exchange performance is inversely related to any negative political event in Turkey because surprising political decisions can lead to steep declines in the Turkish stock exchange. Similarly, Gok and Dayi (2018) also found contradicting evidence that political events have a significant negative impact on the Turkish stock market. Kaya et al. (2015) also found that the BIST100 index is inversely related to political risk in Turkey. However, in this present study, increased geopolitical risk in Turkey was found to have an insignificant impact on the Turkish Stock Market Index XU100. The insignificant impact of geopolitical risk on Turkish Stock Market Index XU100 was explained by Günay (2016). As per Günay (2016), the geopolitical risks in Turkey during recent times have been substantially low as compared to the previous regimes, because of which its impact on the Turkish Stock Market Index may have become insignificant. Although the quantity of breaks has risen in recent times, the level of risk in recent periods was substantially low as compared to the previous regimes, and the trend of risk level for entire regimes shows a downward slope.

5.0 Conclusion, Limitations, and Recommendations

5.1 Conclusion

The Turkish stock market performance and how it is impacted by the political and economic factors of the country have been studied by various researchers in the past, yet still, the research is ongoing. In this regards, the aim of this study was to empirically evaluate how the Turkish stock market, Borsa Istanbul, is affected by political and economic decisions made by the government in Turkey. The time series historic monthly data for the variables of political and economic decisions of the Turkish government for 27 years, starting from January 1994 to December 2020, was collected from Trading Economics and Bloomberg website database. The data was analysed using multiple regression analysis where one political variable, namely; Geopolitical Risk Index indicating the level of geopolitical risk in Turkey, and three economic variables, namely; Real Effective Exchange Rate indicating Turkey’s currency exchange stability, Consumer Price Index indicating the rate of inflation, and Discount Rate indicating the interest rate used in money market instruments in Turkey, were used. The Turkish stock market XU100 Index was used as the dependent variable to measure the Turkish stock market performance.

The results of the multiple regression analysis depicted that the impact of the Geopolitical Risk Index was insignificant on XU100 Index. Therefore based on this finding, the null hypothesis 1 (H01: Geopolitical Risk Index (GPR) has a significant negative impact on Turkish Stock Market Index (XU100)) was proven invalid. It means if geopolitical risk in Turkey increases, then it will insignificantly impact the performance of the Turkish Stock Market. In simple terms, the geopolitical risk in Turkey is not likely to bring any significant change in the XU100 index.

However, the impact of the Consumer Price Index, Real Effective Exchange Rate, and Discount Rate was significantly negative on XU100. Therefore, based on the results the remaining null hypotheses (H02: Real Effective Exchange Rate (REER) has a significant negative impact on Turkish Stock Market Index (XU100)), (H03: Consumer Price Index (CPI) has a significant negative impact on Turkish Stock Market Index (XU100)), and (H04: Discount rate (DR) has a significant negative impact on Turkish Stock Market Index (XU100)) were proven valid. The findings depicted that the three economic variables in Turkey, REER, CPI, and DR, have a significant negative impact on the Turkish Stock Market Index (XU100). It means if Turkey’s currency exchange stability based on REER, rate of inflation based on the Consumer Price Index, and rate of interest based on the Discount Rate in Turkey increases, then, it will significantly decrease the performance of the Turkish Stock Market in terms of reducing the XU100 index.

The findings of this study correspond with the findings of Tiryaki and Tiryaki (2018) and Günay (2016). Where, Tiryaki and Tiryaki (2018) found that the performance of Turkish Stock Market in terms of XU100 index can be negatively impacted by changes in the interest rate in Turkey, while Günay (2016) found insignificant impact of geopolitical risk on Turkish Stock Market Index XU100. However, the findings of this study contradict the findings of Tiryaki and Tiryaki (2018), Gok and Dayi (2018), Kaya et al. (2015), and Aktas and Oncu (2006). It is because Tiryaki and Tiryaki (2018) found that economic variables, namely, REER and CPI, can positively impact the XU100 index; however, in this study, the economic variables REER and CPI were found to have a negative impact on the XU100 index. Aktas and Oncu (2006) also found contradictory evidence to this study by finding that Turkish stock exchange performance is inversely related to any negative political event in Turkey. The negative impact of political events on the Turkish stock market performance was also found by Gok and Dayi (2018) and Kaya et al. (2015). Therefore it is concluded that the Turkish stock market, Borsa Istanbul, can be affected negatively by economic decisions made by the government in Turkey in terms of increased inflation, increased interest rate, and increased currency exchange stability. However, the Turkish stock market, Borsa Istanbul, is not significantly impacted by the political decisions made by the government in terms of increased geopolitical risk. Nevertheless, it can be argued that the geopolitical risk in the recent time was not comparatively higher than in previous eras in Turkey. Therefore, the impact of geopolitical risk on the Turkish stock market, Borsa Istanbul, was not significant in recent times.

5.2 Limitations

The first limitation of this study is that data for a limited number of years was available, due to which a longer sample was not possible to select. Moreover, it was difficult to collect historic data for the macroeconomic variables which were older than 1994 and therefore, the older data could not be selected for analyse in this study. Besides, this study was completed by using multiple regression analysis to test the causal relationship between the variables, and therefore, the results were limited to multiple regression analysis. Another limitation of this study was associated with time; limited time and resources were allowed for this study, and therefore, it was completed within a period of one month. In this study, only one variable of political decision and three variables of economic decisions of the government were used. The impact of the variable of the political decision on the stock market performance of Turkey was found to be insignificant, and therefore, if more variables of political decision had been used, then the findings of this study may have been different. However, the results were limited to only one variable of political decision of Turkey’s government.

5.3 Recommendations

In this section, recommendations are made for the Turkish stock market investors and for future research direction. The findings of this study suggested that Borsa Istanbul can be affected negatively by economic decisions made by the government in Turkey. If inflation, interest rate (discount rate), and currency exchange stability in Turkey are increased, then it will negatively impact the Turkish stock market performance, and the XU100 index will decrease. Therefore it is suggested to the Turkish stock market investors that they shall monitor the inflation, interest rate (discount rate), and currency exchange stability and expect the XU100 index to fall when inflation, interest rate (discount rate), and currency exchange stability is increased. There are limited studies present in which the impact of the political and economic decisions made by the Turkish government on Turkish stock market performance is evaluated. Therefore, for future research direction, it is suggested to conduct more studies to fill the gap by evaluating how political and economic decisions made by the Turkish government can impact Turkish stock market performance. In future studies, it is suggested to use more variables of political decisions (other than geopolitical risk index) because in the present study, only this variable of political decision was used.

Bibliography

Aktas, H. & Oncu, S. (2006). The Stock Market Reaction to Extreme Events: The Evidence from Turkey, International Research Journal of Finance and Economics, 6(1), 78-85. Online; https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.319.6510&rep=rep1&type=pdf

Baek, K., & Qian, X. (2011). An analysis on political risks and the flow of foreign direct investment in developing and industrialized economies Economics, Management, and Financial Markets, 6(4), pp. 60-91.

Baldacci, E., Gupta, S., & Mati, A. (2011). Political and fiscal risk determinants of sovereign spreads in emerging markets Review of Development Economics, 15(2), pp. 251-263.

Bekhet, H. A., & Mugableh, M. I. (2012). Investigating the equilibrium relationship between macroeconomic variables and the Malaysian stock market index through bounds tests approach. International Journal of Economics and Finance, 4(10), 69-81.

Bilson, Christopher M., Timothy J. Brailsford and Vincent C. Hooper (2002), “The Explanatory Power of Political Risk in Emerging Markets”, International Review of Financial Analysis, Vol. 11, Issue 1, pp. 1-27.

Bloomberg (2020). Borsa Istanbul 100 Index (XU100). https://www.bloomberg.com/quote/XU100:IND

Bryman, A., & Bell, E. (2015). Business research methods. Oxford University Press, USA.

Çam, A. V. (2014). The relationship between political risk and firm value: an application on companies in ISE Doğuş Üniversitesi Dergisi, 15(1), pp. 109-122.

Chen, Dar-Hsin, Feng-Shun Bin and Chun-Da Chen (2005), “The Impacts of Political Events on Foreign Institutional Investors and Stock Returns: Emerging Market Evidence From Taiwan, International Journal of Business, Vol.10, No. 2, pp. 165-188.

Diamandis, P. F., & Drakos, A. A. (2011). Financial liberalization, exchange rates and stock prices: Exogenous shocks in four Latin America countries. Journal of Policy Modeling, 33, 381–394.

Economic Policy Uncertainty (2012). Geopolitical Risk Index. Online https://www.policyuncertainty.com/gpr.html#:~:text=The%20Geopolitical%20Threats%20(GPT)%20index,newspapers%20and%20starts%20in%201985.

Erdem, C., Arslan, C. K., & Erdem, M. S. (2005). Effects of macroeconomic variables on Istanbul stock exchange indexes. Applied Financial Economics, 15(14), 987-994.

Field, A. (2013). Discovering Statistics Using IBM SPSS Statistics. New York, SAGE.

Gok, I. Y., & Dayi, F. (2018). The Effects of Political Uncertainty on the Turkish Stock Market: An Event Study Analysis. 2nd International Scientific Conference – Eman 2018 – Economics and Management: How to Cope With Disrupted Times, Ljubljana – Slovenia, March 22, DOI: https://doi.org/10.31410/EMAN.2018.191

Günay, S. (2016). Is Political Risk still an Issue for Turkish Stock Market? Borsa Istanbul Review, 16(1), pp. 22-31. http://dx.doi.org/10.1016/j.bir.2016.01.0032214-8450/

Hasan, A., & Nasir, Z. M. (2008). Macroeconomic factors and equity prices: An empirical investigation by using ARDL approach. The Pakistan Development Review, 47 (4), 501-551.

İkizlerli, D., & Ülkü, N. (2011). Political risk and foreigners’ trading: evidence from an emerging market Emerging Markets Finance and Trade, 48(3), pp. 106-121.

Kartal, M. T., Depren, Ö., & Depren, S. K. (2020). The determinants of main stock exchange index changes in emerging countries: evidence from Turkey in COVID-19 pandemic age. Quantitative Finance and Economics 2020, Volume 4, Issue 4: 526-541. doi: 10.3934/QFE.2020025

Kaya, B. A., & Güngör, M. S. (2015). Özçomak Politik Risk Yatırımcının Dikkate Alması Gereken Bir Risk Midir? Borsa Istanbul Ornegi Gazi Universitesi Iktisadi ve Idari Bilimler Fakultesi Dergisi, 16(1), pp. 74-87.

Kesternich, I., & Schnitzer, M. (2010). Who is afraid of political risk? Multinational Firms and their Choice of capital structure Journal of International Economics, 82(2), pp. 208-218.

Khan, J., & Khan, I. (2018). The Impact of Macroeconomic Variables on Stock Prices: A Case Study of Karachi Stock Exchange. Journal of Economics and Sustainable Development. Vol.9, No.13, 2222-2855.

Le Vu, Quan and Paul J. Zak (2006), “Political Risk and Capital Flight”, Journal of International Money and Finance, Vol. 25, Issue 2, pp. 308-329.

Lobo, B. J. (2002). Interest rate surprises and stock prices. Financial Review, 37(1), 73-91.

Mehdian, S., Nas, T., & Perry, M. J. (2005). An Examination of Investor Reaction to Unexpected Political and Economic Events in Turkey, First International Conference on Bussiness, Management and Economics, 16-19 June 2005, Cesme-İzmir, Turkey.

Mehdian, S., Nas, T., and Perry, M. J. (2005), “An Examination of Investor Reaction to Unexpected Political and Economic Events in Turkey”, First International Conference on Bussiness, Management and Economics, 16-19 June, 2005, Cesme-İzmir, Turkey.

Muhammad, N., & Rasheed, A. (2002). Stock prices and exchange rates: are they related? Evidence from South Asian countries. The Pakistan Development Review, 41(4), 535-550.

Oguz, Z. (13 October, 2020). The Unintended Consequences of Turkey’s Quest for Oil Forthcoming in MER issue 296 “Nature and Politics”. MERIP. Online; https://merip.org/2020/10/the-unintended-consequences-of-turkeys-quest-for-oil/

Peiro, A. (2015). Stock prices and macroeconomic factors: Some European evidence. International Review of Economics and Finance.

Şanlisoy, S., & Kök, R. (2010). Politik İstikrarsızlık-Ekonomik Büyüme İlişkisi: Türkiye Örneği (1987–2006) Dokuz Eylül Üniversietsi İİBF Dergisi, 25(1), pp. 101-125.

Saunders, M. N., Lewis, P. & Thornhill, A. (2012). Research Methods for Business Students. London: Pearson.

Sonmez, F. (2007). Does Inflation Have an Impact on Conditional Stock Market Volatility?: Evidence from Turkey and Canada. International Research Journal of Finance and Economics, 22(6), pp. 427-435.

Tiryaki, A., & Tiryaki, H. N. (2018). Determinants of Turkish Stock Returns under the Impact of Economic Policy Uncertainty. International Journal of Economic and Administrative Studies, 147-162. https://dergipark.org.tr/en/download/article-file/591244

Tiwari, A. K., Dar, A. B., Bhanja, N., Arouri, M., & Teulon, F. (2015). Stock returns and inflation in Pakistan. Economic Modelling, 47, 23-31.

Trading Economics (2020). Turkey Stock Market (XU100). Online; https://tradingeconomics.com/turkey/stock-market#:~:text=The%20Istanbul%20Stock%20Exchange%20National,is%20a%20capitalization-weighted%20index.

Vadlamannati, K. C. (2012). Impact of political risk on FDI revisited – an aggregate firm-level analysis International Interactions, 38, pp. 111-139.

Appendices

Appendix 1 – Descriptive Statistics

| GPR TURKEY | INTEREST RATE (DISCOUNT RATE) | REAL EFFECTIVE EXCHANGE RATE (REER) | TURKEY CPI | XU100 | |

| Mean | 113.4484 | 32.78781 | 97.67972 | 31.82580 | 439.8003 |

| Median | 105.6842 | 25.00000 | 100.6650 | 10.92000 | 394.4750 |

| Maximum | 251.8664 | 79.00000 | 127.7200 | 130.6000 | 1476.720 |

| Minimum | 44.10559 | 8.750000 | 60.52000 | 3.990000 | 1.410000 |

| Std. Dev. | 39.88736 | 21.35541 | 15.68141 | 33.44880 | 368.2605 |

| Skewness | 0.894892 | 0.410838 | -0.249631 | 1.144131 | 0.420115 |

| Kurtosis | 3.550745 | 1.609094 | 2.153719 | 2.967246 | 1.947611 |

| Observations | 324 | 324 | 324 | 324 | 324 |

Appendix 2 – Multiple Regression Analysis

| Dependent Variable: XU100 | ||||

| Method: Least Squares | ||||

| Date: 04/22/21 Time: 05:20 | ||||

| Sample: 1994M01 2020M12 | ||||

| Included observations: 324 | ||||

| Variable | Coefficient | Std. Error | t-Statistic | Prob. |

| C | 1665.806 | 72.40213 | 23.00769 | 0.0000 |

| GPR_TURKEY | 0.398486 | 0.210052 | 1.897079 | 0.0587 |

| DISCOUNT_RATE | -13.59288 | 0.709967 | -19.14579 | 0.0000 |

| REER | -7.747222 | 0.622088 | -12.45359 | 0.0000 |

| TURKEY_CPI | -2.161322 | 0.508997 | -4.246235 | 0.0000 |

| R-squared | 0.854941 | Mean dependent var | 439.8003 | |

| Adjusted R-squared | 0.853122 | S.D. dependent var | 368.2605 | |

| S.E. of regression | 141.1344 | Akaike info criterion | 12.75261 | |

| Sum squared resid | 6354135. | Schwarz criterion | 12.81096 | |

| Log-likelihood | -2060.923 | Hannan-Quinn criteria. | 12.77590 | |

| F-statistic | 470.0277 | Durbin-Watson stat | 1.871629 | |

| Prob(F-statistic) | 0.000000 | |||

Appendix 3 – Multicollinearity Analysis

| Model | Collinearity Statistics | ||

| Tolerance | VIF | ||

| 1 | (Constant) | ||

| GPR Turkey | .878 | 1.138 | |

| Discount rate | .268 | 3.728 | |

| REER | .648 | 1.543 | |

| Turkey CPI | .213 | 4.700 | |

a. Dependent Variable: XU100

Appendix 4 – Normal Q-Q Plots

GPR Turkey

Discount rate

REER

Turkey CPI

XU100

Appendix 5 – Scatter plot to test the presence of Heteroscedasticity